Uncategorized

UK #businessintelligence: 6m #companies 25m #directors 6m #b2b leads 1.2k #industries + #finance #metrics + #kpi’s = £90 per qtr

Enjoy 20% discount on all subscription rates during June 2015 with voucher code 0615KYC20DISC at OODUTTY.COM

UK #businessintelligence: 6m #companies 25m #directors 6m #b2b leads 1.2k #industries + #finance #metrics + #kpi’s = £90 per qtr

Enjoy 20% discount on all subscription rates during June 2015 with voucher code 0615KYC20DISC at OODUTTY.COM

Something is rotting under Silicon Valley

What We Know From A Decade Of SaaS

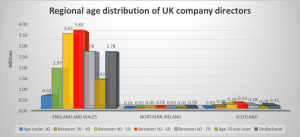

Quick facts – England and Wales and 40-60 year olds dominate UK directorships

The regional age distribution of UK company director appointments is dominated by England and Wales which has over 93% of directorships and 40 – 60 year olds who hold approximately 44% of all directorships.

| Region | Age under 30 | Between 30 – 40 | Between 40 – 50 | Between 50 – 60 | Between 60 – 70 | Age 70 and over | Undisclosed | All ages | % |

| England and Wales | 0.62 | 1.97 | 3.65 | 3.83 | 2.78 | 1.42 | 2.78 | 17.05 | 93.4% |

| Northern Ireland | 0.01 | 0.02 | 0.05 | 0.05 | 0.03 | 0.02 | 0.06 | 0.24 | 1.3% |

| Scotland | 0.03 | 0.09 | 0.20 | 0.24 | 0.18 | 0.08 | 0.15 | 0.96 | 5.3% |

| Total (millions) | 0.66 | 2.08 | 3.89 | 4.11 | 2.99 | 1.52 | 2.98 | 18.25 | 100.0% |

| % | 3.6% | 11.4% | 21.3% | 22.5% | 16.4% | 8.3% | 16.3% | 100.0% |

Source: UK Companies House, November 2014

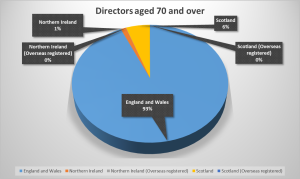

Quick facts – The over 70’s hold approx. 1.5 million UK directorships

The over 70’s hold approximately 1.5 million or 8.2% of the 18.3 million UK company directorships.

Figures revised to exclude directors with undisclosed age.

| Region | Directors aged 70 and over | % |

| England and Wales | 1,420,094 | 93% |

| Northern Ireland | 18,317 | 1% |

| Northern Ireland (Overseas registered) | 902 | 0% |

| Scotland | 82,464 | 5% |

| Scotland (Overseas registered) | 381 | 0% |

| 1,522,158 | 100% |

We build data dams so that we can mine, slice, dice and transform

At OODUTTY.COM we build data dams so that we can mine, slice, dice and transform these into business and financial data intelligence.

Our mission is simple: To aggregate public domain, enterprise and web data sources ‘one-one-dutty’ at a time to empower the next generation through data intelligence!

OODUTTY.COM Quickfacts – In Sep 2014, UK companies reported net current assets of £11.5 billion

During Sept 2014, 166,887 UK companies reported net current assets totalling approximately £11.5 billion in their annual accounts filed with Companies House!

Net current assets include stock, debtors, cash and bank balances but excludes trade creditors.

| Sep 2014 financial metrics | ||

| Country | Net Current Assets £m | % |

| E&W | £10,788 | 93.4% |

| NI | £271 | 2.3% |

| SC | £489 | 4.2% |

| Grand Total | £11,548 | 100.0% |

- Get the FREE Summary financial metrics for Sep 2014 from OODUTTY.COM store

- Why not try the OODUTTY Data Manager to easily group and pivot September 2014 KPI’s. This is available on bulk data purchases over £2,500

- Get our Q4’2014 Special bulk data offer of £0.50 or 50p per annual accounts for September 2014 account filings

- Delivery options include: ftp download, email, downloaded or DVD by special post

Email sales@oodutty.com for further information.

Chinese walls separating credit from savings and investments

Is it just me or are there others who feel they are being legged-over by retail banks and financial institutions that offer both credit facilities and saving and investment products?

Don’t get me wrong, I have a soft spot for the big investment banks since they’ve provided me with an above-average income for over two decades. However, I’ve recently been chatting with Frank, an old friend of mine, who is now running an ethical peer-to-peer lending business and he has helped to open my eyes to what goes on in retail banking.

After questioning Frank about the type of clients that his business is attracting, I was not surprised to learn that in reaching their decisions to refuse credit to some of Frank’s clients, the major high street banks and lending institutions had employed the services of the UK credit reference agencies – Experian, Equifax and Callcredit. These credit reference agencies are now basically licenced to print money since they’re protected by statute to access the national electoral register, customer credit records at banks, credit and store card companies, public utilities and other enterprises.

What I found interesting was the fact that some of Frank’s clients were not hand-to-mouth borrowers at all. Some merely wanted the flexibility to keep their current savings and investment portfolios intact while borrowing to satisfy a specific medium term requirement whether it be buying a car, holiday or upgrading their home. One can argue that this is the same principle that UK high street banks use when they go to the Bank of England or the ECB with their begging bowls for short term loans. Not to mention the global credit crunch of 2007-2011 when they were begging to use the taxpayers money – yes, the same people from the national electoral register. The moral of the story so far is that any one of us from the humble shop floor worker to the mighty ‘masters of the universe’ can fall on hard times.

So what’s the big deal? No one (i.e. the man in the street) is entitled to credit from banks and lending institutions (i.e. the same folks that almost bankrupted the nation’s pensioners after their collapse). This is the government’s and the credit reference agencies standpoint.

Moral hazard

This one-dimensional view of the electorate as being high risk borrowers irks me a lot. What about the electorate’s other assets: property, premium bonds, government bonds, stocks and shares, index and tracker and esoteric funds, ISA’s, ETF’s, ETP’s, SIPP’s and all that other toxic stuff that the gets blasted at us with impunity in the daily and weekly mass media so that the government, banks and financial institutions can borrow from the electorate mostly with the cursory risk warning that ‘investments can go up or down and you may lose your original capital’.

Which clever snake oil pedlar sold the idea that borrowing from the electorate should be considered as risky investments rather than as loans to banks and other financial institutions so they can generate revenue while, on the other hand, loans and mortgages from these institutions to the electorate have to repaid in full with interest. Further, if the electorate don’t pay then they’re blacklisted and or bankrupted by the banks and financial institutions with the help of credit reference agencies, but when these banks and financial institutions go bust they are rescued by the state using the tax payers funds and let off to prey on the electorate like count Dracula.

I must now refocus my attention to the cosy relationship between credit reference agencies, government and lending institutions with the following questions:

1. Is it right for me to keep my hard-earned savings and investments with a bank or financial institution that refuses to give me credit based wholly or partially on the three monopolistic UK credit reference agencies?

2. Is it right for a bank or financial institution that transacts daily current account, savings and investments business with existing customers to use a third party credit reference agency for lending decisions regarding those same customers?

3. Is it right for a bank or lending institution having performed the requisite due diligence checks including KYC – Know Your Client – during account opening to later employ a credit reference agency to rate the same customers with whom they regularly transact savings and investment business?

4. Is it right for a bank or lending institution to continue in a borrowing relationship through savings and investment products with clients subsequent to their decision to refuse credit to those same clients?

5. Is it right for a bank or lending institution to borrow money from consumers using savings and investment products without these institutions themselves being credit assessed on individual transaction prior to accepting customers’ money?

If the majority of readers answer ‘No’ to these questions, then banks and financial institutions present a moral hazard to society by:

- borrowing the electorate’s savings and investments to generate revenue and profits without themselves being credit assessed on every such transaction, while simultaneously, using credit reference agencies to assess the same electorate with whom they are transacting and peddling borrowing products

My personal recommendations are:

1. If a bank or lending institution, credit assess existing customers who they transact savings and investment business with, then on refusal of customers’ credit applications, the banks or lending institution should also:

a) include in their refusal notice all savings and investment products, including insurance policies, that they hold on behalf of the customers impacted by the credit refusal;

b) recommend a list of independent financial institutions that the customers impacted by the credit refusal can switch their savings and investment products to;

c) stipulate clearly that the financial institutions’ refusal to offer credit whilst borrowing from the impacted customer represents a conflict of interest and a moral hazard and therefore, it’s in the interest of the customer to research the market for another financial institution that may better serve their interest for both savings and investments and credit facilities.

2. In particular, internet peer-to-peer lending and crowd-funding enterprises should NOT use credit reference agencies since this will constrain the scalability of their business model to the same population of customers available to banks i.e. ‘the credit reference agencies say Yes’ cohort. Instead, peer-to-peer and crowd-funding business should leverage the titans of the internet to disrupt the cosy trio of credit reference agencies and scale their business model to capture the population of ‘the credit reference agencies say No’ cohort. How? Simple: use the internet titans- eBay, PayPal, Amazon etc. to perform preliminary ID and Verification (ID&V) checks by:

a) requesting applicants to send a refundable payment of £1 – from their main current account and/or credit cards – using PayPal since payment notification will included verified address and location. This can be refunded after successful application

b) use text messaging to verify applicant’s telephone numbers and social network links to verify other attributes

c) additional ID&V for date of birth etc. – passport, driver’s licence etc. – can be sent via registered post along with evidence to confirm ownership of assets including mortgage accounts for property, savings and investments and confirmation of employment / self employment data capture on initial application

d) always post written confirmations to the address supplied by eBay, PayPal, Amazon etc. and create Red flags for post returned as ‘Move away’ and ‘Not known at this address’

A new pension model for the 21st century

I will take up the subject of pensions in another article. However, my question is: shouldn’t pension savings be the mirror image of a residential mortgage? Pension savings are no different to mortgages on residential property – the pension saver should be granted a charge on the pension provider’s property for every penny he contributes until retirement, plus the addition of annual compound interest. Thus, every penny saved in a pension, plus compound interest should be handed back to retirees and if this cannot happened then the defaulting financial institutions assets should be repossessed and sold off to repay the debt in full.

This blog is intended to disrupt the cosy status quo of retail banking and other financial institutions that use monopolistic credit reference agencies in the UK to discredit lives while establishing Chinese walls to profit from the tax payers hard earned income and savings.

If you feel strongly about empowerment through data intelligence for next generation living then please take a few minutes to complete the form below. Your feedback will be used to analyse the extent to which banks and financial institution along with credit reference agencies are operating Chinese walls between savings and investment and lending products.

Oodutty